A Monthly Subscription Funds Calculator is usually a digital Instrument designed to assistance people monitor and control their monthly subscription expenses. The main objective of the calculator is to deliver a transparent overview of just how much money is spent on recurring products and services each month.

If you're employed inside of a town and have to purchase parking every day or every month you usually tend to have the capacity to save by using general public transportation.

Field Rationalization: Get started by entering the identify of every subscription support in the first input discipline, and also the monthly Expense in the next input field. Make sure the Value is entered as being a numeric benefit.

Expression lifetime insurance policy is just not an financial investment, it’s just life insurance coverage, however the premiums are much reduced. My viewpoint is usually that a time period existence coverage is best for most people, and Then you can certainly make investments the various which you’re conserving by not purchasing whole lifestyle or universal lifestyle insurance coverage.

In place of likely out and shelling out money on leisure, you'll be able to remain at your home and also have a relatives video game night time. Activity nights may be many pleasurable and it encourages additional time jointly as a family members.

Take a look at extra checking accountsBest checking accountsBest free of charge examining accountsBest online checking accountsChecking account alternatives

Why is my calculated total unique from my lender statement? Discrepancies can occur from rounding, differences in billing cycles, or unaccounted subscriptions.

Or maybe you’ll wait around until eventually it goes on sale or the cost drops. And Even when you do sooner or later end up purchasing it at a similar price you’ve at the least delayed the purchase and saved subscription calculator some money Meanwhile. You’ll uncover that have significantly less buyer’s remorse plus much more money as part of your checking account any time you hold out on buys.

The amount of equipment do you've got with your garage/drop/basement which you’ve only employed once or twice? In the event you’re like most of us (myself included), you might have at the least several. And tools may be expensive.

Rather than utilizing the dryer, you can dry apparel on an outside clothesline or on indoor drying racks. When you've got a family members you most likely do loads of laundry, and the price of functioning the dryer all the time actually provides up.

Make it a pattern to only run your washing machine and dishwasher when you have a complete load. Normally, you’re paying out additional on drinking water and energy than you should.

Getting monetary goals is very important. In case you don’t have goals or even a prepare you’re not likely to at any time have A lot good results in taking care of your own personal funds.

Take into account that securities are not insured by the FDIC, usually are not deposits or other obligations of the lender and they are not guaranteed by a bank. They're topic to expense risks, including the feasible loss of your principal.

This method can be especially useful when your financial savings accounts are focused on precise goals, like establishing an emergency fund, having to pay off personal debt, going on a holiday or building a down payment.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Jennifer Love Hewitt Then & Now!

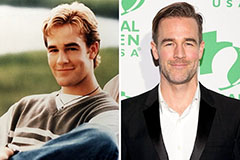

Jennifer Love Hewitt Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Batista Then & Now!

Batista Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!